Medicare Part A covers the following services:

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing (deductibles, coinsurances, copayments) for Medicare-covered services.

Most people do not pay a monthly Part A premium because they or a spouse have 40 or more quarters of Medicare-covered employment. In 2023, if a person has less than 30 quarters of Medicare-covered employment the Part A premium is $506 per month. If a person has 30 to 39 quarters of Medicare-covered employment, the Part A premium is $278 per month.

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing (deductibles, coinsurances, copayments) for Medicare-covered services.

The 2023 Part-B premium is $164.90 per month (premiums will be higher for individuals with annual incomes of $97,000 or more and married couples with annual incomes of $194,000 or more.)

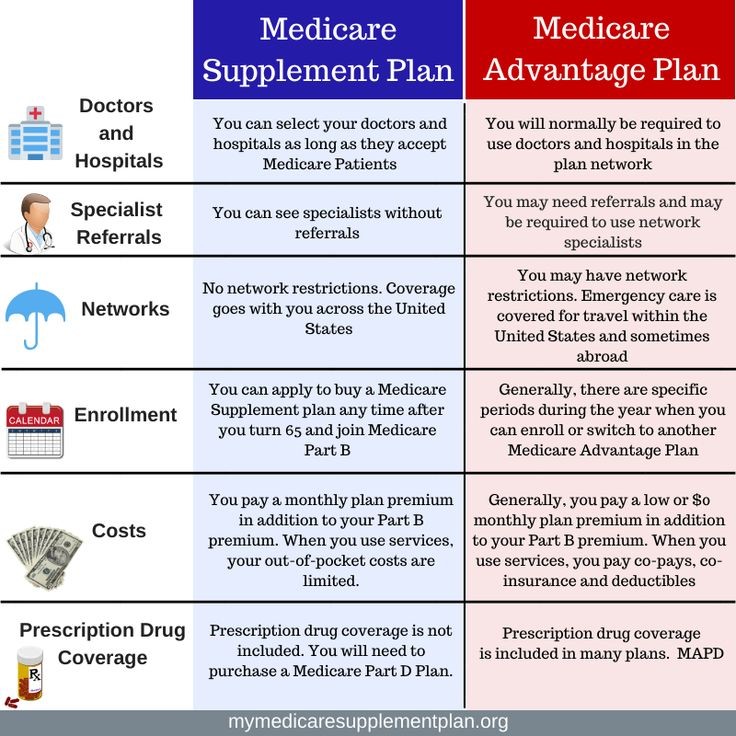

Medicare Advantage Plans.

You can choose to get your Medicare coverage through a Medicare Advantage Plan (Part C) instead of through Original Medicare Parts A & B.

Medicare Advantage Plans must offer, at minimum, the same benefits as Original Medicare (those covered under Parts A and B) but can do so with different rules, costs, and coverage restrictions. You also typically get Part D as part of your Medicare Advantage benefits package (MAPD). Many different kinds of Medicare Advantage Plans are available. You may pay a monthly premium for this coverage, in addition to your Part B premium.

If you join a Medicare Advantage Plan, you will not use the red, white, and blue Medicare card when you go to the doctor or hospital. Instead, you will use the membership card your private plan sends you to get health services covered. You will also use this card at the pharmacy if your health plan has Medicare prescription drug coverage (Part D).

If you’re a higher-income beneficiary, you’ll pay a larger percentage of the total cost of Part B based on the income you report to the Internal Revenue Service (IRS). You’ll pay monthly Part B premiums equal to 35, 50, 65, 80, or 85 percent of the total cost, depending on what you report to the IRS.

There’s the additional 0.9% tax on income above $200,000 for individual filers and $250,000 for joint filers, and the 3.8% tax on investment income of more than $200,000/individual and $250,000/joint. Once you turn 65, you can sign up for Medicare no matter how rich you are.