Dealing With Inflation / Taxation

Lorem ipsum dolor sit amet consectur adipiscing elit sed eiusmod ex tempor incididunt labore dolore magna aliquaenim ad minim veniam quis nostrud exercitation ullamco laboris.

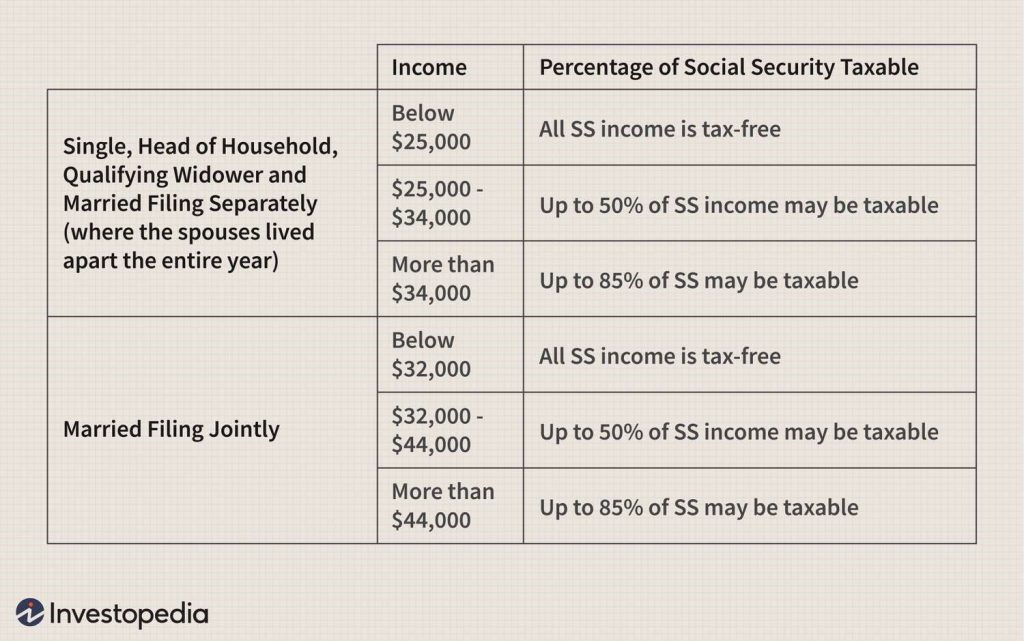

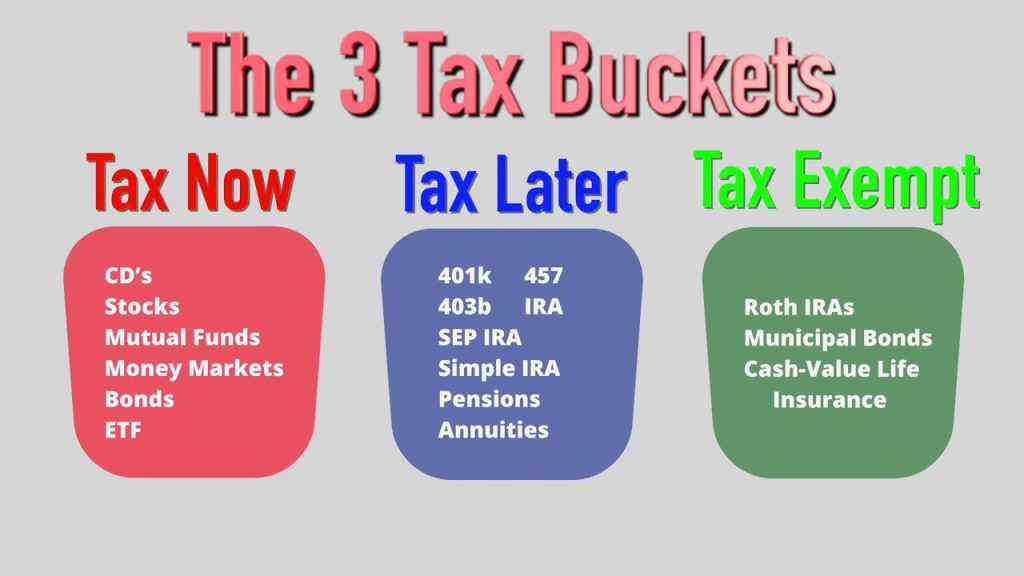

Simply put, tax-free investing refers to any investment in which the interest, dividends, or capital gains are exempted from federal, state, or local taxes. This type of investment can be a powerful tool in your wealth-building arsenal, helping to maximize returns and minimize the impact of taxes on your overall financial picture.

Roth IRA

Roth 401(k)

Higher Risks = Higher Rewards & Bigger Potential Losses

Lower Risks = Moderate Rewards & Guarantee Floor / Cap on Losses

The sooner you move from Tax Now & Tax Later Buckets to the Tax-Exempt Bucket with your Investments (Money) the more control you have providing the Retirement You Want.