Contributions have been tax-deferred. This means your contributions are deducted from your pay before taxes are calculated, and you pay taxes on them when you begin receiving monthly retirement benefits or if you elect a refund of your contributions. This is a benefit to you because your current taxable income is lowered and the amount of annual taxes you pay is less than if you made contributions after paying taxes.

Retirement Formula: Your annual benefit = ______% of average final compensation x years and months of creditable service.

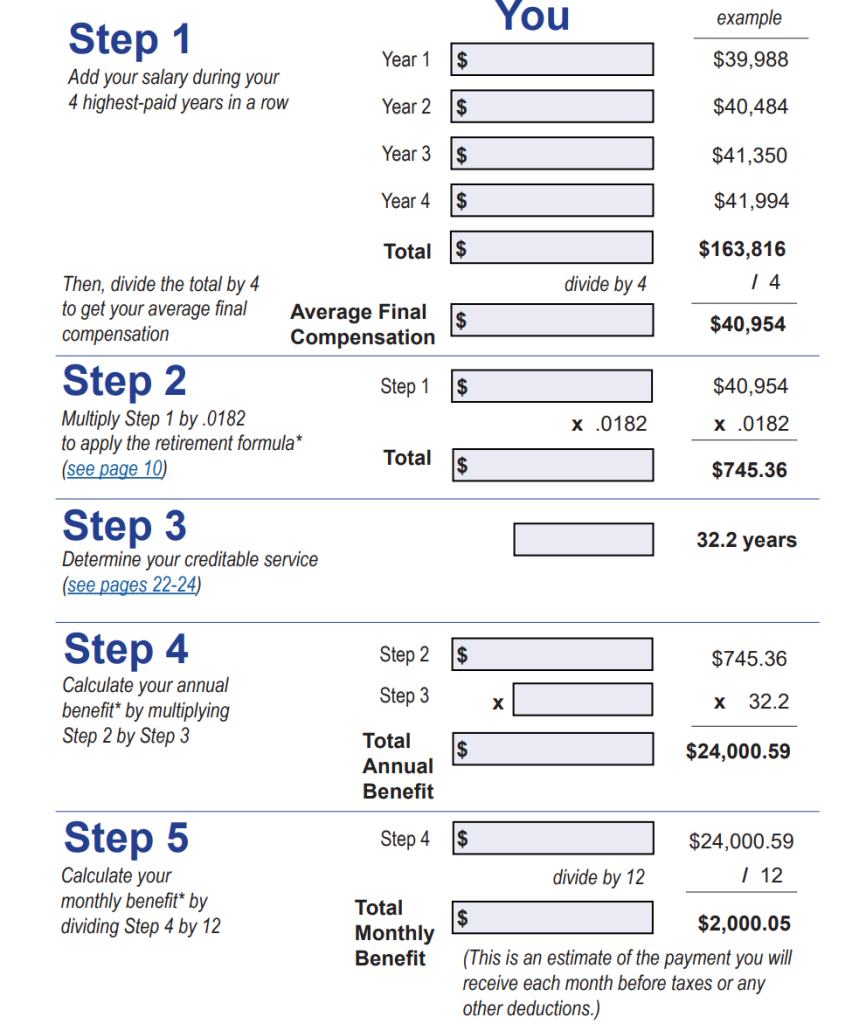

Service Retirement Calculation Example:

Assume employee Mary Benson works for 10 months per year and retires at age 60 with 32 years and two months of creditable service and an average final compensation of $40,954. Because Mary has more than 30 years of creditable service at retirement, she receives her basic benefit of about $24,000 a year (about $2,000 monthly) for the rest of her life under the maximum allowance. Monthly payments would stop at her death. The following steps show how we calculate Mary’s benefit. Use the spaces in the left-hand column to fill in your figures for an estimate of your benefit.